Get the free venerable trust certification form

Show details

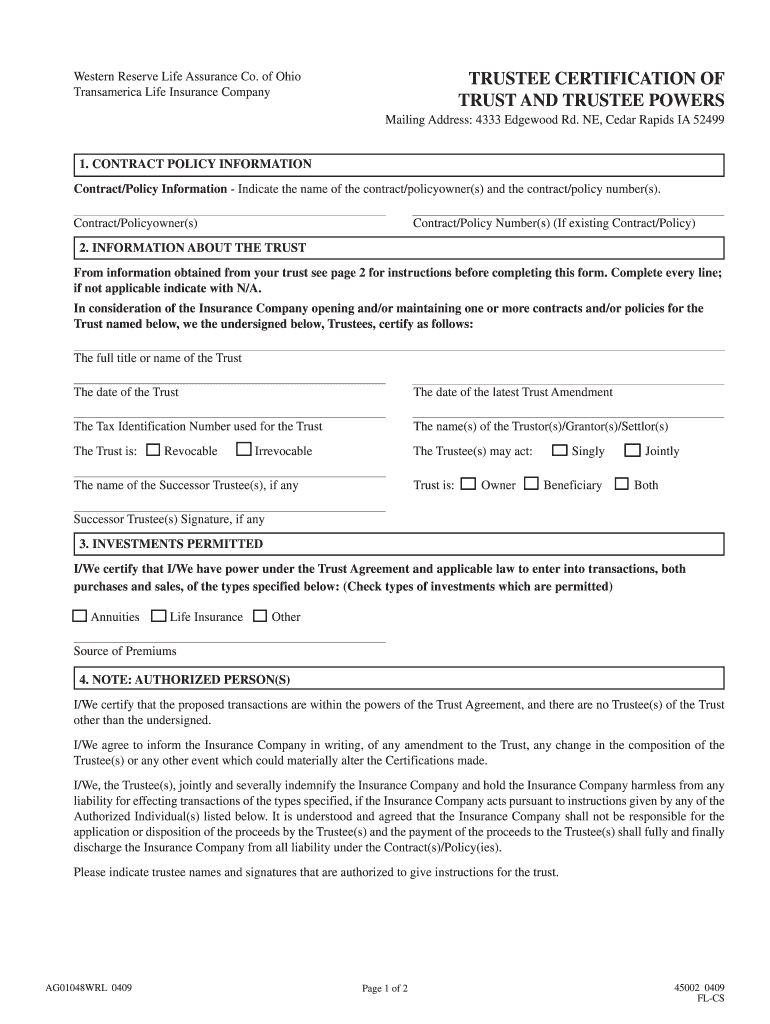

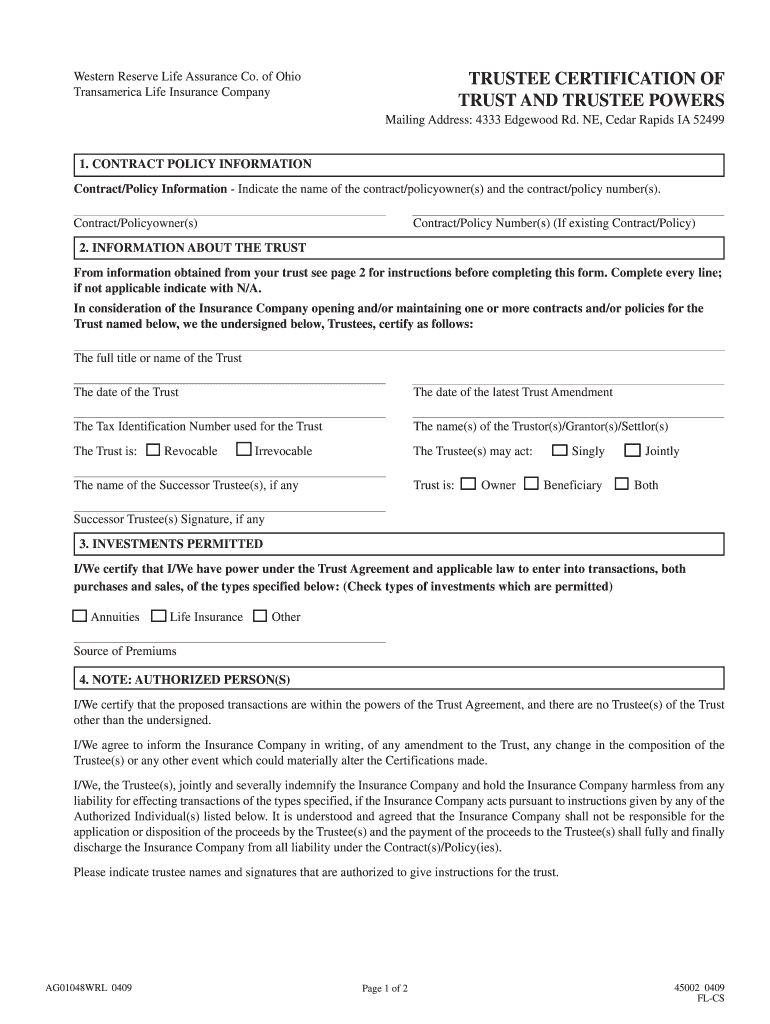

Western Reserve Life Assurance Co. of Ohio Transamerica Life Insurance Company TRUSTEE CERTIFICATION OF TRUST AND TRUSTEE POWERS Mailing Address 4333 Edgewood Rd.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transamerica trust certification form

Edit your trust certification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transamerica life insurance company trust certification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit venerable trust certification form online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit venerable trust certification form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out venerable trust certification form

How to fill out trust certification form:

01

First, gather all the necessary information and documents that will be required to complete the form. This may include personal identification, proof of address, and relevant legal documents.

02

Once you have the required information, carefully read through the form and ensure you understand all the fields and requirements.

03

Begin filling out the form by entering your personal information accurately, such as your full name, date of birth, and contact details.

04

Provide any additional information or documentation that is specifically requested on the form, such as information about the trust or details about the assets being held in trust.

05

If there are any sections that you are unsure about or require further clarification, don't hesitate to contact the relevant authority or seek legal advice.

06

Double-check all the information you have entered before submitting the form to ensure accuracy and completeness.

07

Sign and date the form as required, following any specific instructions provided.

08

Keep copies of the completed form for your records.

09

Submit the filled out trust certification form to the appropriate authority or organization as instructed.

Who needs trust certification form:

01

Individuals who are setting up a trust or acting as a trustee may need to fill out a trust certification form. This includes individuals who want to create a trust for estate planning purposes, asset protection, or charitable giving.

02

Financial institutions or banks may also require trust certification forms from individuals or entities looking to open trust accounts or perform trust-related transactions.

03

Legal professionals or tax advisors may use trust certification forms as part of their services for clients who require assistance with trust-related matters.

Fill

form

: Try Risk Free

People Also Ask about

What is a certificate of trust in Oregon?

Certificate of Trust is the document used to identify who made the Living Trust, who the Trustees are, what powers the Trustees have, what kind of Trust it is and when it came into existence.

Why you need a trust in Illinois?

Creating a living trust in Illinois can be a valuable estate planning tool giving you control over your assets, avoidance of probate, and a useful estate planning tool. A revocable living trust Illinois may be right for you. An Illinois living trust is created during the grantor's life.

How does a trust work in Illinois?

A living trust is a legal framework that you can place assets and property in. The trust is established by a document. A trust has a trustee who is in charge of managing the trust and distributing the property to the trust's beneficiaries ing to its instructions.

Does a trust have to be filed with the court in Illinois?

Trust documents are generally private and not filed with the court. To learn about how the trust works, the beneficiaries need to be able to receive a copy of the document.

What is certificate of trust in Illinois?

A certification of trust provides information about the settlor of the trust, the acting trustee, and the power and authority of the trustee to manage and invest trust property or to act with respect to a specific transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit venerable trust certification form from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including venerable trust certification form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an eSignature for the venerable trust certification form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your venerable trust certification form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit venerable trust certification form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign venerable trust certification form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is trust certification form?

A trust certification form is a legal document that verifies and certifies the existence and details of a trust, including its terms and conditions, the identity of the trustee, and the beneficiaries.

Who is required to file trust certification form?

Typically, the trustee of the trust is required to file the trust certification form when dealing with financial institutions, real estate transactions, or any legal matters that require proof of the trust's existence.

How to fill out trust certification form?

To fill out a trust certification form, one must provide details such as the name of the trust, date of its creation, names and addresses of the trustees and beneficiaries, and a statement affirming that the trust is valid and still in effect.

What is the purpose of trust certification form?

The purpose of the trust certification form is to provide legal proof of the trust's existence and terms, helping to facilitate transactions, clarify authority, and protect the interests of beneficiaries.

What information must be reported on trust certification form?

The information that must be reported on a trust certification form includes the trust name, its effective date, the trustee's name and contact information, a list of beneficiaries, and a statement regarding the authenticity of the trust documents.

Fill out your venerable trust certification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Venerable Trust Certification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.